ASX rebounds after Wall Street's big bounce led by miners and energy stocks — as it happened

The ASX followed Wall Street's Friday rally with a 0.8 per cent rebound of its own on Monday.

Miners and energy stocks led the way after China announced a new stimulus package to boost domestic demand.

Look back at how the day unfolded on our blog.

Disclaimer: this blog is not intended as investment advice.

Live updates

Market snapshot

- ASX 200: +0.8% to 7,8 po54ints (live values below)

- Australian dollar: flat at 63.32 US cents

- Asia: Nikkei +1.3%, Hang Seng +1.3%, Shanghai -0.1%

- Wall Street (Friday): Dow +1.7%, S&P 500 +2.1%, Nasdaq +2.6%

- Europe (Friday): DAX +1.9%, FTSE +1.1%, Eurostoxx +1.4%

- Spot gold: -0.1% to $US2,983/ounce

- Brent crude: +0.7% to US$71.10/barrel

- Iron ore (Friday): +1.7% to $US104.00 a tonne

- Bitcoin: +0.3% to $US83,479

Prices current around 4:20pm AEDT

Live updates on major ASX indices:

Goodbye

That's it for another day on the blog.

Not a bad day with the ASX 200 picking up 0.8%, but perhaps not as strong as first thought.

Looking ahead, Wall Street's Friday rally doesn't appear to have legs with futures trading pointing to a 0.5% decline on opening.

Once again thank for your company, the blog will be back again suitably refreshed with loins girded early tomorrow morning.

Back to the cave...

LoadingOn The Business tonight with Kirsten Aiken

On The Business tonight with Kirsten Aiken:

- Emilia Terzon reports on migrant workers being excluded from workers compo schemes.

- Kirsten catches up with veteran budget commentator Chris Richardson who offers a deep dive into federal finances ahead of next week's budget.

- Kirsten also talks to TenCap's Jun Bei Liu about why financial markets started the week on a more positive footing.

That's The Business tonight at 8:45pm AEDT on ABC News, or after the Late News on ABC-TV, or catch up anytime on ABC iView

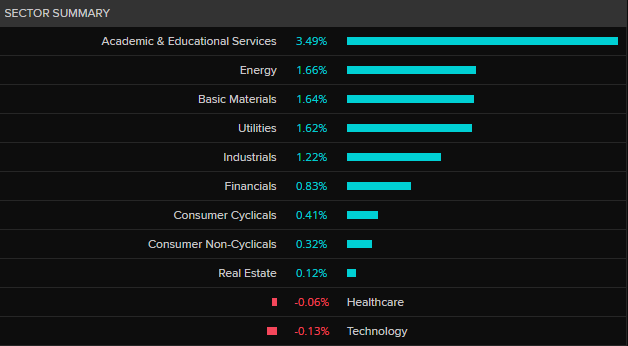

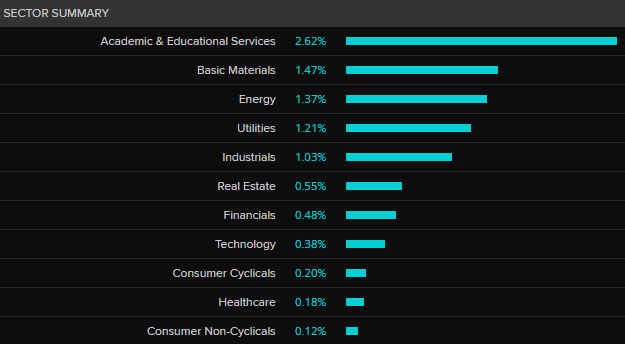

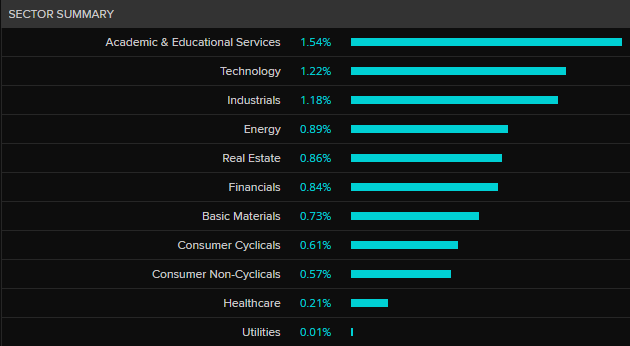

ASX 200 closes 0.8% higher, buoyed by energy and miners

The ASX ended the day higher after Wall Street's S&P 500's 2% rebound on Friday.

While not in lock step with the US rally, most sectors made gains with the ASX 200 closing up 0.8% at 7,854 points while the broader All Ordinaries rose 0.9% to 8,082 points

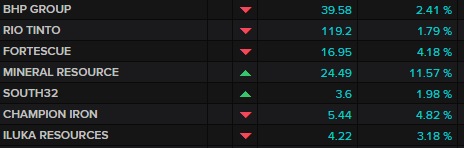

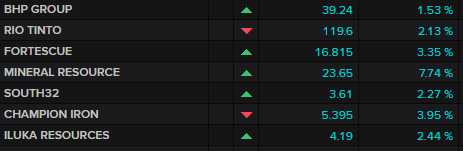

The miners did most of the heavy lifting after China signalled over the weekend it would launch a new stimulus package targeting the domestic economy.

Energy stocks also made solid gains with the refiner/retailers Viva and Ampol up 3.8% and 2.6% respectively and Woodside up 1.9% after signing a long-term contract with a Chinese power company.

The banks generally had a good day with only NAB going backwards after news that its long-term CFO was heading across to Westpac.

The big winner on the All Ords was small cap EFTPOS operator Smartpay up 47% to 78 cents on a takeover offer from rival player Tyro, which is offering around 90 cents a share.

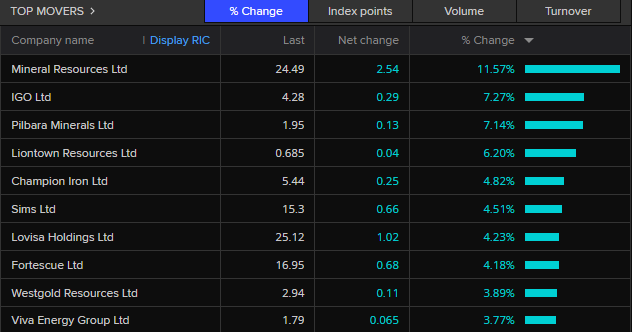

On the ASX 200 the big winner was Mineral Resources (+11.6%) on the back of a hefty broker upgrade from UBS.

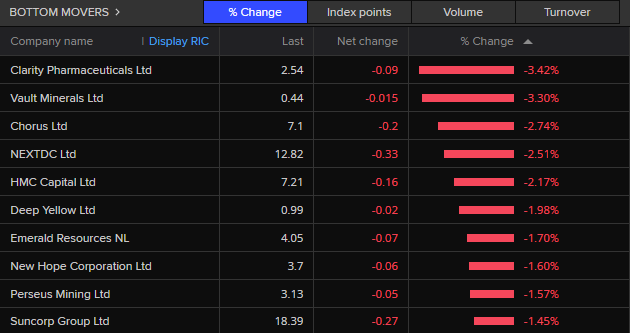

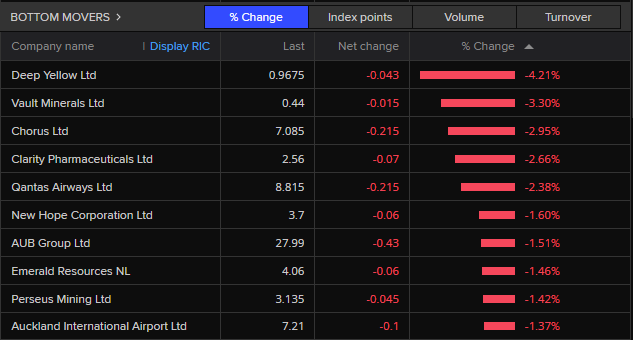

Clarity Pharmaceuticals (3.4%) was the poorest performer on the ASX 200 after receiving a broker downgrade.

Across the region most markets were having solid sessions with Japan's Nikkei and the Hang Seng in Hong Kong up 1.3%, while Shanghai was a bit softer.

The Aussie dollar was flat but still holding above 63 US cents.

Mosaic workers entitled to $21 million in government support

Good afternoon, Emilia here with you for a little extra information on an investigation I put out today.

My story is about FEG, a long-running scheme run by the government that pays out workers missing entitlements after a company collapse, when there is no clear way to get them quickly through the liquidation or windup process.

In 2024-25, FEG payouts are expected to blow out to more than $300 million.

And that could be thanks to some massive company collapses like Mosaic, the retail empire that owned Rivers, Noni B and Katies.

The federal government has already announced it will fast track FEG payments to Mosaic's thousands of workers, and the amount of entitlements they have pending is huge.

Here's some info I got from the department running FEG:

- Currently, it is estimated that about 2,800 Mosaic staff are owed $21.3 million of entitlements.

- About $20.9 million of this would fall within the Fair Entitlements Guarantee (FEG) caps. FEG has a maximum weekly wage cap of $2,793.

- The department is unable to estimate the number of workers who will be eligible for FEG. It is anticipated some workers would be ineligible based on residency status or because of other eligibility criteria.

- Each claim will be assessed on its merits. The eligibility and entitlements for each claimant will only be confirmed after the assessment process.

- It is estimated that about $870,000 of superannuation is outstanding.

It's worth noting as my story points out, that superannuation isn't covered by FEG, although it has a mechanism where it can help chase down super payments owed to workers.

And that line about some Mosaic workers perhaps not being eligible due to residency status? That's because FEG doesn't cover workers on visas at all.

Read more about FEG and its limitiations here.

Australia's airports landed record profits but not record passenger numbers.

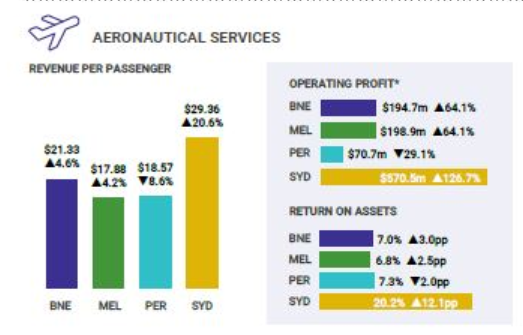

Australia's four largest airports raked in their highest aeronautical revenues last year, despite not achieving record passenger and flight numbers.

The ACCC's Airport Monitoring Report found there had been 24.3 per cent increase in revenues to $2.6 billion occurred despite the four major airports collectively handling fewer passengers than before the pandemic.

While domestic and international passengers grew by 14% to 115 million since 2022-23, passenger numbers remained around 5% below 2018-19 levels.

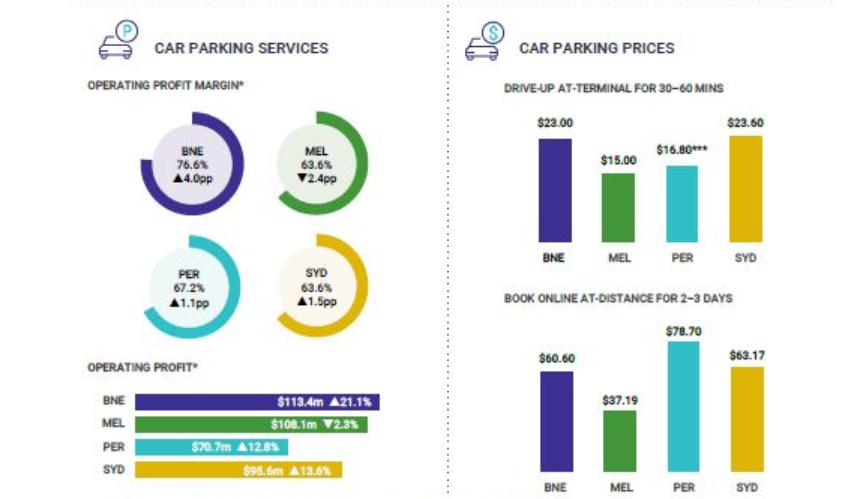

Parking profits also soared to record levels with the four big airports - Sydney, Melbourne, Brisbane and Perth - all making at least 60% margins on motorists.

The figures released today have drawn the ire of airlines who said the results came as little surprise.

Their lobby group Airlines for Australia and New Zealand accused the airports of making super profits, "well above those recorded by airlines, banks, or supermarkets."

"Each year this report shows that the current regulatory regime for airports — based on monitoring alone — is completely ineffective to rein in airport charges," A4ANZ chair, and former ACCC chair, Graeme Samuel said

"Indeed, this report acts as a reminder that a regime involving monitoring alone does little more than shine a light on the challenges of dealing with monopoly airports."

The revenue gains drove a significant increase in profits for the airports with Sydney the most profitable in terms of aggregate and a per passenger basis.

The ACCC found Sydney had an operating profit of $570.5 million, which represented a 20.2% return on its aeronautical assets.

Brisbane and Melbourne airports reported aeronautical operating profits of $194.7 million and $198.9 million respectively, despite Brisbane Airport catering to far fewer passengers than Melbourne Airport.

"Both airports reported a 64.1 per cent increase in aeronautical operating profit in 2023-24," the ACCC said.

The profit bonanza isn't limited to flying, parking has been a massive money spinner as well.

All four airports had profit margins of more than 60% on their parking operations, with Brisbane's airport parking profit up 21% to $113 million.

Melbourne's profit from parking was $108 million, Sydney Airport made $95.6 million while Perth Airport parking made a $70.7 million profit.

"Airports have their hands in passengers' pockets from the moment they enter airport property — including for rental cars, taxi and rideshare surcharges, and in particular car parking," Mr Samuel said.

Mr Samuel said airport should negotiate in good faith as mandated in principles set down in 2007, but never properly mandated.

"If they can't reach an agreement, then it ought to be referred to commercial arbitration, for mediation or expert arbitration.

"It is now up to Government to ensure this solution can be accessed, for the good of all airport customers and the economy more broadly."

ICYMI: Kohler on Australia's net-zero emissions plan and carbon offset credits

We on the blog understand "appointment TV" is struggling as a model, but that doesn't mean it's not worth watching.

Here's a gem from last night you may have missed, Alan Kohler's take on the problems in Australia's carbon credit scheme and what needs to be fixed to reach our net-zero emissions goal.

Loading...Woodside signs first standalone LNG supply deal with China

Woodside Energy has signed a long-term sale and purchase agreement with China Resources Gas International for its liquified natural gas.

Under the terms of the agreement, Woodside will supply approximately 0.6 million metric tons of LNG annually over 15 years, with deliveries set to commence in 2027.

It's Woodside's fourth agreement for long-term LNG sales into Asia signed since the start of 2024.

Woodside Executive Vice President & Chief Commercial Officer Mark Abbotsford said the agreement marks the first time the company on a standalone basis has signed a long-term sale agreement with a customer in China, Asia's biggest customer for LNG.

"We are very pleased to have launched our relationship with China Resources, the country's leading gas utility," Mr Abbotsford said.

It is the first time China Resources has signed an agreement to procure LNG over a period of 15 years.

"The agreement again demonstrates the depth and length of demand for LNG in Asian markets as nations in the region seek to guarantee energy supplies," Mr Abbotsford said.

China Resources Gas Group Chairman Yang Ping said the company was delighted to sign its first sales and purchase agreement with Woodside.

"Woodside's growing global LNG portfolio and its proven track record as an operator have created a solid foundation for the agreement," he said.

"The signing of this SPA will also open up the potential for future cooperation between the two companies globally."

Woodsides shares were up 1.7% to $22.71 at 2:30pm AEDT.

China's economy showing resilience in the face of the trade war

China's economy is defying renewed trade pressures with the latest release of figures showing a pick-up in retail sales and infrastructure spending, but a marginal cooling in industrial production.

Retail sales, an important measure of domestic consumption, rose 4% in the January-February period, better than a 3.7% rise in December and in line with analyst expectations.

Industrial production over the same two-month period grew 5.9% and while better than consensus forecasts, it represents a slowdown from the 6.2% growth reported in December.

Fixed asset investment, which includes property and infrastructure spending, expanded 4.1% in the Jan-Feb period from the same period a year earlier, versus expectations for a 3.6% rise.

On the downside, unemployment edged up to 5.3%, its highest level since 2023 and the property sector continued to struggle with property investment down around 10% over the year.

Senior economist at the Economist Intelligence Unit Tianchen Xu said overall the results were positive.

"The data release suggests a decent momentum in the opening months, even if the economy remains in deflation," he said.

"Retail sales growth was decent, too, reflecting the vital role of subsidies in supporting home appliance and mobile phone sales."

The figures come as Chinese officials start unveiling new stimulatory measures aimed at boosting the domestic economy to shift away from export led growth.

On Sunday, China's State Council released the first steps in a "special action plan" featuring measures to raise wages and pensions, as well as creating incentives to increase the birthrate such as establishing a childcare subsidy scheme.

Further details in the "action plan" are expected to be released later today.

ASX up 0.7%, miners jump on China stimulus

The ASX has opened the week higher after Wall Street's S&P 500 put on 2% to close the week.

While not in lock step with the US rebound, all sectors have made gains and the ASX 200 was up 0.7% at 7,840 points 12:50pm AEDT.

The banks are generally making gains with only NAB going backwards after news that its long-term CFO was heading across to Westpac.

The miners all opened higher on expectations of positive news out of China on a new stimulus package for the domestic economy.

The big winner this morning is small cap EFTPOS operator Smartpay up 48% to 79 cents on a takeover offer from rival player Tyro, which is offering around 90 cents a share.

On the ASX 200 the big winner so far is Mineral Resources on the back of a hefty broker upgrade from UBS.

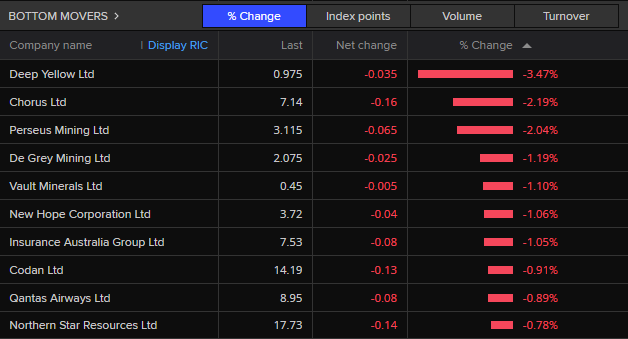

Uranium miner Deep Yellow (-4.2%) is the poorest performer on the ASX 200 so far, while Qantas is down 2.4% as part of a global sell-off in aviation.

Market snapshot

- ASX 200: +0.7% to 7,841 points (live values below)

- Australian dollar: +0.1% at 63.32 US cents

- Asia: Nikkei +1.3, Hang Seng +1.1%, Shanghai +0.4

- Wall Street (Friday): Dow +1.7%, S&P 500 +2.1%, Nasdaq +2.6%

- Europe (Friday): DAX +1.9%, FTSE +1.1%, Eurostoxx +1.4%

- Spot gold: +0.3% to $US2,992/ounce

- Brent crude: +1.1% to US$71.39/barrel

- Iron ore (Friday): +1.7% to $US104.00 a tonne

- Bitcoin: -0.3% to $US83,019

Prices current around 12:45pm AEDT

Live updates on major ASX indices:

ICYMI: Where does Australia fit into the new era of economic nationalism

The trade barriers being built by the US are the most obvious example of nations abandoning free trade and globalisation, but not the only ones.

So, where does Australia fit into this new trend of refashioning industrial policy in the name of self-sufficiency and sovereign capability?

Gareth Hutchens checked it out in this terrific piece.

Greens push for four-day week across Australia

Hi team,

Just jumping in with an interesting update on the four-day week.

Conceptually it doesn't make any sense: getting paid the same to work fewer hours — and getting the same amount done.

So why is it working?

The Greens have today announced an election policy that aims to pave the way for more people to enjoy the four-day week, with nationwide trials and a national institute to coordinate them.

"Ordinary Australians have been working hard for decades and not seeing a fair share of the results. A 4-day week will share more fairly the products of their labour," Greens Senator Barbara Pocock said in a statement.

"Productivity gains over the past two decades have fed into higher profits while real wages have stagnated. A shorter working week alleviates the burden of stress and burn-out. International trials have repeatedly shown productivity increases and a healthier, happier workforce result from shorter working hours.

"The Greens' policy will initiate a series of national trials in different industries where workers work 80% of their normal hours while maintaining 100% of pay. It’s a win-win for everybody."

Forces collide

On paper, the four-day week doesn't work. But in Australian and international trials, 95% of companies that have tried it have kept it.

There are some ideas about why. A lot of it is about the collision of forces that have changed modern work.

You have a shortage of skilled workers, the blurring of work/life time (and the need to do 'life admin' during working hours), and a substantial change in the economy towards so-called knowledge and creative work.

Many of these roles and industries are focused on — and paid by — output rather than time. A system that allows people to focus and compress their work, freeing up a day a week that is spent on rest, exercise or life admin, allows higher efficiency and the same amount of output despite the reduced "work" hours.

Here's Senator Pocock again:

"The UK, Canada, Germany and Spain are leading the way with large scale trials involving thousands of workers. In the UK 92% of employers participating have reported they will continue the 4 day week after the trial ends. It’s time for Australia to move its workplaces into the 21st century and create a pathway for shorter hours.

“The Greens will support a 4 day work week test case through the Fair Work Commission aiming to reduce working hours with no loss of pay.

“Our society is changing, more women and carers are at work, yet we are constrained by archaic labour laws that see the fruits of our efforts swallowed up in profits for bosses and shareholders. This is about justice for working people. We work to live not live to work.

“This is a policy that’s good for everyone. It can increase productivity, reduce absenteeism, improve recruitment and retention and give employees more time to manage their home life. This change will allow workers to create a working week that works for them.”

A couple of years ago I talked to some businesses about why they'd taken on — and kept — the four-day week. Check it out (on your personal, non-work time).

ASX opens higher on Wall Street's positive lead

The ASX has opened higher after Wall Street's S&P 500 put on 2% to close the week.

While not in lock step with the US rebound, all sectors have made gains and the ASX 200 was up 0.8% at 10:30am AEDT.

The banks were generally positive with only NAB going backwards after news that its long-term CFO was heading across to Westpac.

The miners have all opened higher on expectations of positive news out of China on a new stimulus package for the domestic economy.

The big winner this morning is small cap EFTPOS operator Smartpay up 42% to 73 cents on a takeover offer from rival player Tyro which offering around 90 cents a share.

That corporate action has also boosted Zip on the ASX 200 (+4.1%), while the index's big winner is Mineral Resources on the back of a hefty broker upgrade from UBS.

Uranium miner Deep Yellow (-3.5%) is the poorest performer on the ASX 200 so far, while Qantas is down 0.9% as part of a global sell-off in aviation.

Market snapshot

- ASX 200: +0.7% to 7,845 points (live values below)

- Australian dollar: flat at 63.26 US cents

- Wall Street (Friday): Dow +1.7%, S&P 500 +2.1%, Nasdaq +2.6%

- Europe (Friday): DAX +1.9%, FTSE +1.1%, Eurostoxx +1.4%

- Spot gold: +0.2% to $US2,990/ounce

- Brent crude (Friday): +0.6% to US$71.00/barrel

- Iron ore (Friday): +1.7% to $US104.00 a tonne

- Bitcoin: -1.4% to $US82,071

Prices current around 10:20am AEDT

Live updates on major ASX indices:

Bargain hunting, or dead cat bounce?

Bargain Hunting or Dead Cat Bounce ?

- Craig

Thanks for the question, Craig re the use of bargain hunting vs "dead cat bounce" to describe Wall Street's Friday rebound. I guess terms are not mutually exclusive - buying what you think is a bargain doesn't necessarily translate to good value.

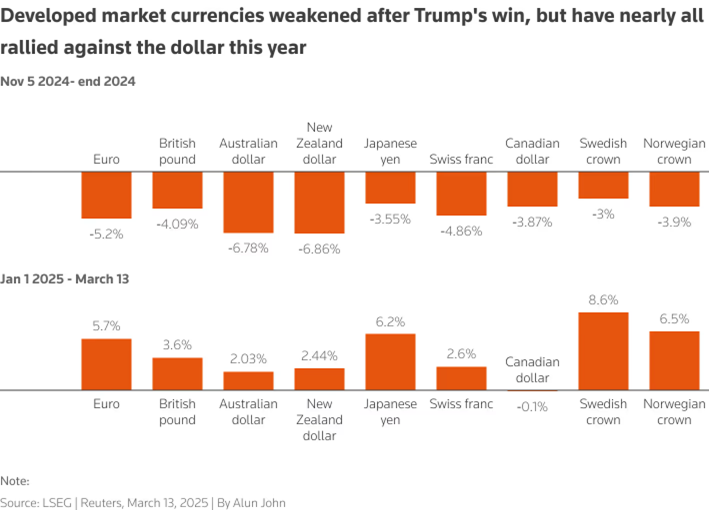

Making others' currencies great again

It may not be what President Donald Trump intended, but his second crack at "Making America Great Again" has boosted the currencies of rival nations.

In the months leading up to the President's January inauguration, most developed economies saw their currencies struggling against the Greenback.

The euro fell more than 5% in the last two months of 2024, the British pound dropped 4% and the Aussie dollar was down close to 7%.

This year they all, plus many other big currencies, have rebounded.

The euro is up almost 6%, the Aussie is up 2% and Japan's yen is up 6%.

China's yuan, which arguably should have suffered more than others given it is Trump administrations tariff crosshairs, has sailed blithely through the turmoil thanks to the tightly managed nature of the currency.

In short, the US dollar has weakened this year against all other developed market currencies, except Canada's.

"Tariffs, generally speaking, tend to be good for the dollar," Barclays FX strategist Lefteris Farmakis told Reuters.

"But when they are applied against very close trading partners, they can harm confidence in the U.S."

The euro has been boosted as European nations, particularly Germany, have signalled increased defence and infrastructure spending and the ECB is likely to end its interest rate easing cycle.

The yen has benefited from the perception that Japan is something of a safe haven, as well as an improving economic outlook will see the BoJ start to raise interest rates again.

The big winner is Sweden's krona, or crown, that has appreciated almost 9% this year.

Sweden's economy has been humming along, and the fact that it has an outsized defence industry hasn't hurt either.

NAB CFO switches to Westpac

There's been a bit of a reshuffle among the big banks' bean counters this morning.

NAB's chief financial officer Nathan Goonan is heading across to rival Westpac after 12 years in the role.

NAB's chief risk officer Shaun Dooley will be acting CFO while the bank searches for Mr Goonan's replacement.

NAB also announced it had recruited Canadian banker Andrew Auerbach to run its Business and Private Banking division replacing Rachel Slade, who will work as a senior advisor to CEO Andrew Irvine.

This week: Australian jobs and global central banks in focus

Australia:

Tue: RBA speech — Bank chief economist Sarah Hunter speaks

Wed: Leading index (Westpac series)

Thu: Labour force (Feb), population growth (Sep)

International:

Mon: CH — retail sales, industrial production, infrastructure investment (Feb)

US — Retail sales (Feb), housing market index (Mar)

Tue: US — Industrial production (Feb), housing starts/building permits ((Feb)

Wed: US — Fed rates decision

JP — Bank of Japan rates decision

Thu: CH — loan prime rates decision

UK — Bank of England rates decision

NZ — GDP

The big release of the week from a local perspective will be Thursday's labour force data.

The jobs market is likely to continue to show strength, which is terrific news for the economy broadly, but arguably still the biggest stumbling block for more rates cuts in the near future.

The CBA is forecasting another 30,000 jobs were added in February with unemployment anchored at around 4.1%.

Internationally, interest rate decisions several big central banks will hold investor intention.

However, rates are expected remain unchanged after meetings by the Fed (Wednesday), Bank of Japan (Wednesday), Peoples' Bank of China (Thursday), the Bank of England (Thursday) and the Swiss National Bank (Thursday).

Takeover battle in EFTPOS sector

Bit of corporate news in the EFTPOS world this morning, with NZ-based operator Smartpay receiving two separate takeover offers, including one from the ASX-listed Tyro.

In a statement to the ASX this morning, Smartpay said Tyro's unsolicited offer was to acquire 100% of its shares at $NZ1.00 a share (approximately 90 Australian cents).

Smartpay last traded on the ASX at 63 cents.

Smartpay didn't name the other interested party, but said both proposals were preliminary and highly conditional.

The EFTPOS world is currently struggling, with the RBA reviewing whether it would restrict fees the providers get for processing debit-card transactions.