Eicher Motors: 100x in the past, 30% CAGR post-Covid: What’s next?

Eicher Motors has long been a favourite among investors, transforming from a Rs 30 stock in 2009 to a multi-bagger success. While Royal Enfield remains its core, the company has evolved into a two-pronged powerhouse, with Volvo-Eicher Commercial Vehicles' industrial engine. Now, as it ventures into global markets, the key question arises: can the company sustain its momentum?

Eicher Motors is no longer just about motorcycles. It’s more global and diversified and has quietly compounded at ~30% CAGR post-COVID over the last five years.

Eicher Motors is no longer just about motorcycles. It’s more global and diversified and has quietly compounded at ~30% CAGR post-COVID over the last five years.Ask any long-term investor in India to name their multi-bagger legends, and Eicher Motors will likely be on the top of that list.

From a Rs 30 stock in 2009 to Rs 3,200 by 2017 (adjusted for stock split), Eicher didn’t just ride the motorcycle boom, it defined it. But Eicher’s success wasn’t just built on bikes; it was built on vision. It spotted aspiration before the market even knew it existed and built a lifestyle brand around it.

The result? One of the most iconic wealth creation stories in Indian market history.

Fast-forward to 2025: Eicher Motors is no longer just about motorcycles. It’s more global and diversified and has quietly compounded at ~30% CAGR post-COVID over the last five years.

Now comes the key question: Can it fire up another multi-year rally, or has the best already been priced in?

Let’s take a closer look.

Eicher Motors Ltd. Share Price Chart (Apr’ 06 till Apr ‘25)

Stock Price Movement of Eicher Motors. Source: Screener.in

Stock Price Movement of Eicher Motors. Source: Screener.in

Under the hood: A business built for dual-engine growth

Once known solely for its iconic thump, Eicher Motors has evolved into a two-pronged powerhouse, driven by Royal Enfield’s premium motorcycle legacy and Volvo-Eicher Commercial Vehicles (VECV) steady industrial engine.

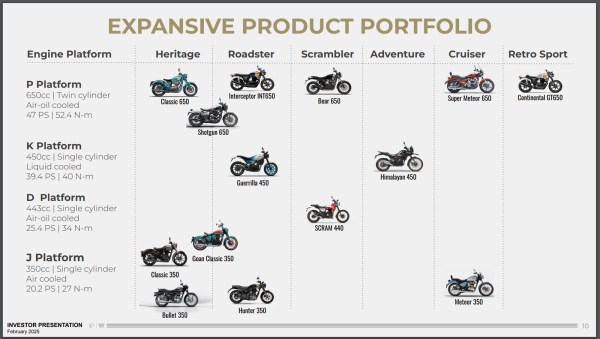

Royal Enfield Product Portfolio. Source: Investor Presentation Dec 24

Royal Enfield Product Portfolio. Source: Investor Presentation Dec 24

What makes Eicher interesting today isn’t just its heritage, it is how both arms of the business are poised to capture growth across very different markets.

Royal Enfield: Building on legacy, targeting global dominance

The heart of Eicher’s brand and its most powerful earnings engine remains Royal Enfield.

Despite the cluttered two-wheeler market in India, Royal Enfield’s positioning in the mid-weight motorcycle segment (250cc-750cc) gives it a distinct competitive edge.

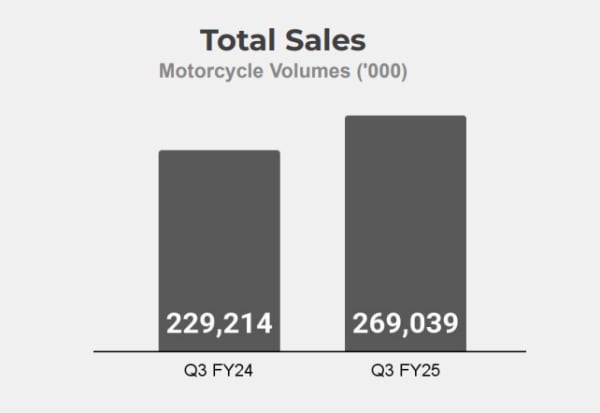

In Q3FY25, Royal Enfield posted strong volume growth of 17.5% YoY, selling over 2.7 lakh units.

Motorcycle YoY Sales. Source: Investor Presentation Dec 24

Motorcycle YoY Sales. Source: Investor Presentation Dec 24

This growth came despite an average selling price (ASP) of Rs 1.80 lakh per bike, a slight dip due to an evolving product mix, but still reflecting pricing strength in a value-conscious market.

What’s notable is that this growth wasn’t driven by legacy models alone. Royal Enfield launched five new motorcycles during the quarter, including the Bear 650, Bullet Battalion Black, and Scram 440.

The company also inaugurated a CKD (completely knocked down) assembly plant in Thailand to cater to ASEAN markets and has another facility in Brazil in the final stages of development. These facilities will allow Royal Enfield to bypass import duties and meet regional demand efficiently.

Adding a future-forward layer, Royal Enfield unveiled its much-anticipated EV brand: Flying Flea. Production is expected to begin in Q1FY26 at its Vallam plant, with an annual capacity of 1.5 lakh units.

Rather than rushing into the EV race, Eicher seems to be laying the groundwork for a scalable electric offering.

VECV: The quiet contributor with scale potential

While Royal Enfield defines the brand, VECV, Eicher’s joint venture with Volvo, is an increasingly important contributor to both revenue and diversification.

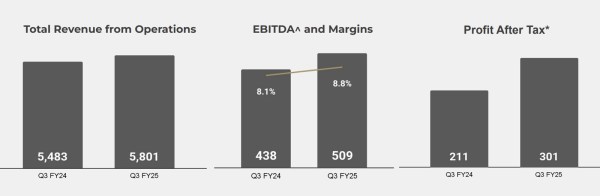

In Q3FY25, VECV generated Rs 5,801 crore in revenue, a 6% increase YoY, and posted 42% PAT growth. EBITDA margin came in at 8.8%, up 80 basis points year-on-year.

VECV YoY Sales. Source: Investor Presentation Dec 24

VECV YoY Sales. Source: Investor Presentation Dec 24

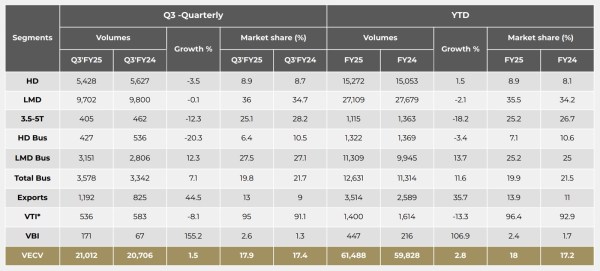

Volumes were stable at 21,012 units, but the market share story is more telling.

VECV now controls ~36% of the Light & Medium Duty (LMD) truck market, ~9% in Heavy Duty (HD) trucks, and over ~20% in buses.

VECV Quarterly and YTD Sales. Source: Investor Presentation Dec 24

VECV Quarterly and YTD Sales. Source: Investor Presentation Dec 24

With the government’s infrastructure push and last-mile logistics demand on the rise, VECV is well-positioned to benefit.

A key future lever for this segment is Pro-X, VECV’s new ‘electric-first’ LCV platform. This could open a new market segment for Eicher in the 2-3.5 ton range, an increasingly important category in e-commerce and intra-city logistics.

Financial discipline: Growth without stretching the balance sheet

Amid expansion, Eicher has maintained one of the cleanest balance sheets in the Indian auto industry.

As of FY25, the company remains debt-free with a commitment of over Rs 1,000 crore in capex this year, aimed at product development, EV readiness, and global capacity expansion.

Management on Capex Plan. Source: Investor Presentation Dec 24

Management on Capex Plan. Source: Investor Presentation Dec 24

Operating metrics also remain robust.

Return on Equity (RoE) has held steady at around 24%, and earnings per share (EPS) is projected to grow implying a steady mid-teens earnings CAGR.

Valuation check: What’s priced in, and what isn’t?

Note: This is not a prediction of where the stock price could head. It’s just an if-then calculation for academic purposes.

At the current market price of around Rs 5,400, Eicher Motors trades at ~33x FY25 earnings. That might raise eyebrows in a market where many auto stocks hover in the 15–25x range.

But there’s important context here.

Eicher has never traded like a typical auto company because it has rarely behaved like one.

Historically, the stock has commanded a premium multiple, not just due to Royal Enfield’s brand equity, but because of its ability to consistently deliver high return ratios, strong free cash flows, and net-cash balance sheets, all while expanding into new growth avenues.

Even now, return on equity stands at 24%, free cash flow yield is healthy, without any debt on the books.

Yet, the recent rally has already priced in a fair share of optimism. The next phase of valuation expansion, if any, will likely depend on the execution and outcome of several strategic initiatives currently underway.

A key variable will be the scalability of international operations, particularly through the CKD assembly model in Thailand, Brazil, and other markets. These facilities are designed to lower import costs and improve margins in export markets.

If these regions begin to meaningfully contribute to both volume and profitability, it could improve the earnings quality over the medium term.

Additionally, the launch and acceptance of the EV portfolio under the Flying Flea brand, beginning FY26, will be closely monitored.

Early indicators around product-market fit, cost structure, and volume potential will play a role in determining the long-term relevance of this vertical.

On the commercial vehicle side, VECV’s ability to maintain margin discipline while scaling volumes in light- and medium-duty trucks, buses, and newer EV-first platforms will influence consolidated financial performance.

Trends in government infrastructure spending and last-mile logistics will remain important demand drivers.

If execution across these areas is in line with expectations, and if margin recovery follows the current investment cycle, the business may support a valuation re-rating toward a higher earnings multiple over time.

However, any deviation in growth momentum, international performance, or EV ramp-up could impact valuation stability, especially in a market where expectations are already elevated.

In the current context – marked by rising benchmark indices, a premium on predictable earnings, and investor focus on capital-efficient businesses, Eicher Motors’ positioning remains consistent with market trends. Further upside or compression in valuation multiples will depend on the alignment between stated strategic goals and actual delivery.

Note: This article relies on data from the annual report and industry reports. We have used our assumptions for forecasting.

Parth Parikh has over a decade of experience in finance and research and currently heads the growth and content vertical at Finsire. He has a keen interest in Indian and global stocks and holds an FRM Charter along with an MBA in Finance from Narsee Monjee Institute of Management Studies. Previously, he held research positions at various companies.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities, or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, and resources and only after consulting such independent advisors as may be necessary.

Must Read

Buzzing Now

Mar 31: Latest News

- 01

- 02

- 03

- 04

- 05