Stocks see worst day since 2020 in wake of Liberation Day - Newsquawk US Market Wrap

- SNAPSHOT: Equities down, Treasuries up, Crude down, Dollar down

- REAR VIEW: Tump tariffs more aggressive than expected; Canada matches US 25% auto tariff; Spanish PM calls for European Commission to reinforce trade links with rest of world; Poor US ISM Services PMI; Initial claims fall, continued claims rise expectations; Atlanta Fed GDPnow (Q1) revised higher, but still in contraction; OPEC+ agree to larger-than-expected supply hike in May; Softer-than-expected Swiss CPI; Money markets price assign 60% probability of a fourth Fed rate cut this year; MS no longer see Fed cuts in 2025; MSFT said to pull back on data centre projects globally.

- COMING UP: Data: German Industrial Orders, Swedish CPIF, US & Canadian Labour Market Reports. Event: Moody's to review the EU's sovereign rating. Supply: Australia. Speakers: Fed’s Powell, Barr, Waller; ECB’s de Guindos.

More Newsquawk in 2 steps:

- 1. Subscribe to the free premarket movers reports

- 2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

MARKET WRAP

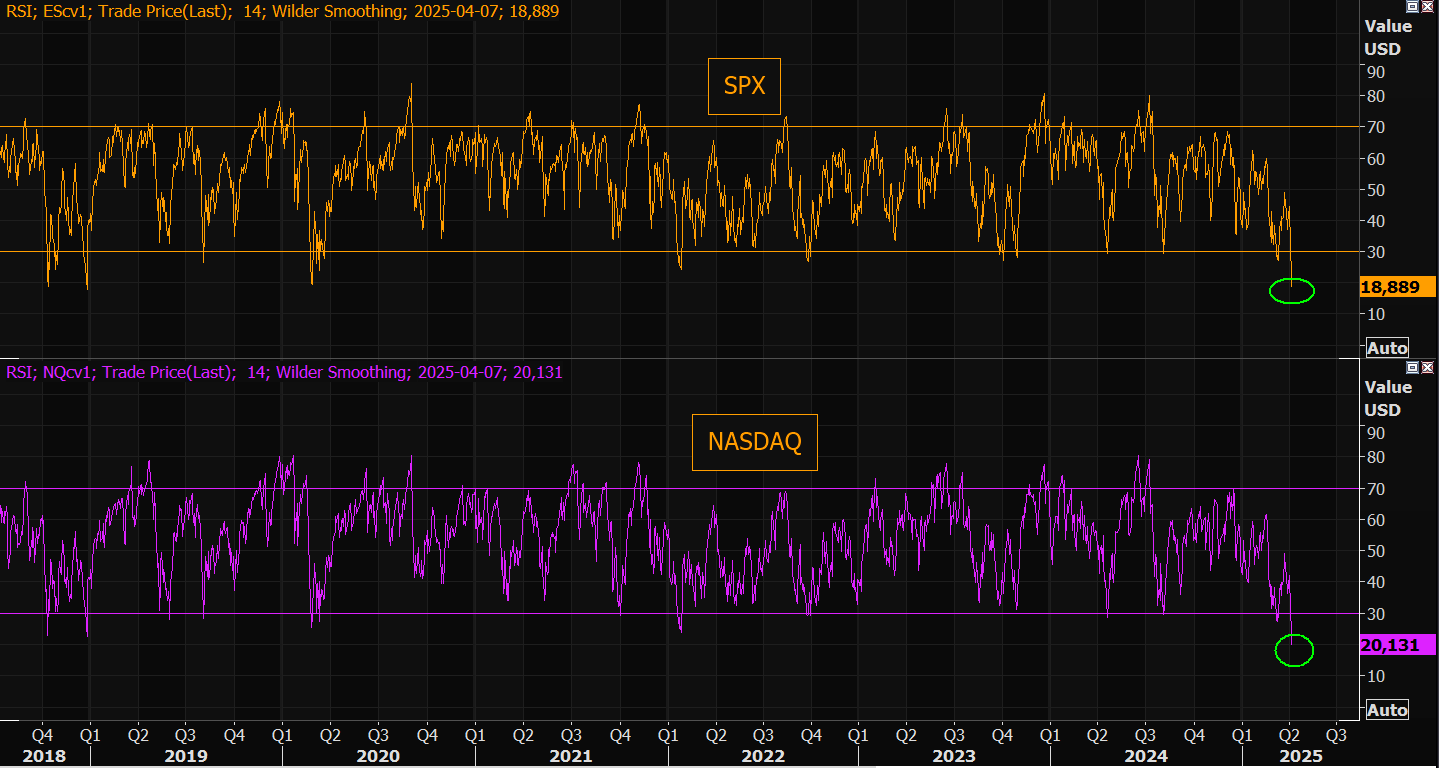

It was a risk-off day in the wake of Liberation Day after US President Trump announced more aggressive tariffs than expected. Stocks tumbled (SPX -4.8%, NDX -5.4%, DJI -4%, RUT -6.6%) while the vast majority of sectors saw losses, with Energy, Tech, Consumer Discretionary and Industrials seeing losses greater than 5% on the day. The only sector to close green was Consumer Staples. Elsewhere, T-notes rallied while the dollar nose-dived on the economic slowdown fears in the wake of the aggressive tariffs. Fed pricing also was dovish, with ~ an extra 20bps of easing now priced for 2025. 90bps of easing is now priced for year-end, which fully prices three 25bps rate cuts and a 60% probability of a fourth. In FX, havens (CHF and JPY) outperformed while gold prices initially hit fresh record highs overnight but sold off thereafter with steep equity losses, likely seeing participants take profit in gold to cover equity losses. Meanwhile, given the rally in gold this year - with some of the upside likely due to front-running potential tariffs- this was unwound as Bullion is exempt from US tariffs, reducing the tariff-fear premium on the yellow metal. Baseline tariffs are set to come into effect on April 5th, with reciprocal tariffs on April 9th. Focus on the market is largely on what retaliatory measures other countries will take with France calling on European countries to cancel investments into the US, while others like Italy do not wish to use more tariffs against tariffs. China will, however, take countermeasures, and Spain has asked the European Commission to reinforce trade links with the rest of the world. Elsewhere, US data was mixed. ISM Services PMI disappointed, with downside in both employment and prices. Initial Jobless Claims fell but Continued Claims rose. Challenger Layoffs skyrocketed, but primarily due to DOGE layoffs. The US trade deficit was narrower than expected. Data largely was put to one side with the market focus heavily on trade updates, but NFP is due on Friday with Fed Chair Powell thereafter.

US

US LIBERATION DAY REVIEW: US President Trump said that nations that treat the US badly they will calculate the total rate charged, including non-monetary barriers and will charge them half of that rate and, therefore, won't be fully reciprocal. Accordingly, he announced the US is to apply a 20% tariff on imports from the EU, 34% tariff on imports from China, 26% tariff on imports from India, 25% tariff on imports from South Korea, 10% tariff on imports from the UK and 24% tariff on imports from Japan. Trump also stated that the baseline tariff is 10% and announced 25% auto tariffs, while Canada and Mexico were not subject to reciprocal tariffs for now. US President Trump's tariff order exempts gold, according to Reuters citing a White House fact sheet. That said, gold was sold on the day as some of the tariff-fear premium was unwound in spot (investors were buying gold ahead of tariffs in case Trump were to implement a gold tariff). US Treasury Secretary Bessent said will have to wait and see on negotiations of tariffs and advised countries not to panic or retaliate, while he added the latest tariffs are at the high end of the number if there is no retaliation. A Senior US official said the baseline tariff rate will go into effect on April 5th at 00:01EDT and reciprocal tariffs will go into effect on April 9th at 00:01EDT, while President Trump’s automobile tariffs took effect 00:01EDT on April 3rd, according to the Federal Register. On metals, the US has excluded steel, aluminium, and gold from reciprocal tariffs, providing some relief to domestic buyers who are already paying 25% duties on these key metals used in industries like automobiles and appliances. A Senior White House official also noted that products covered by Section 232 tariffs, including autos, steel, aluminium, copper and lumber, will not be included. Meanwhile, the pharmaceutical industry received a temporary reprieve from the sweeping tariffs announced by President Trump, though the relief may be short-lived as the White House plans additional levies on pharmaceutical imports in the future, Bloomberg reported. Other exemptions from the reciprocal tariff policies include energy (e.g. Saudi oil) and other "certain minerals not available in the US". Following the event, Barclays said it sees a "high risk" of the US economy falling into a recession this year. Expects 2025 US GDP growth to contract 0.1% Q/Q, while Goldman Sachs suggested the latest US tariffs would further drag China's GDP growth by around 1 percentage point, taking the total drag to 1.7 percentage points. Fed views differ: UBS Global Wealth Management expects the Fed to deliver 75-100bps of rate cuts over the remainder of the year; notes that even if tariffs are reduced by year-end, near-term shock is likely to drive a near-term slowdown in the US economy. Conversely, Morgan Stanley no longer expects the Fed to cut rates in June 2025 due to "tariff-induced inflation". Now, MS expects the Fed to remain on hold until March 2026. MS said that if tariffs persist, US economic growth may suffer, with downside risks increasing. Effective tariffs could reach 22% versus 3% at the year's start, raising inflation risks and keeping the Fed from cutting rates in June.

ISM MANUFACTURING PMI: ISM Services fell to 50.8 in March from 53.5, and below the expected 53.0. Within the release, employment plunged to 46.2 from 53.9, while new orders dropped to 50.4 (prev. 52.2). Inflationary gauge of prices paid dipped to 60.9 from 62.6, while business activity slightly rose to 55.9 from 54.4. Backlog of orders and new export orders both fell into contractionary territory. As was in the case in the Manufacturing PMI, and as expected, tariff talk dominated the respondents responses. Recapping some, 1) Starting to see effects of aluminium tariffs, and these costs will be passed on to customers; 2) Tariffs have caused issues in the groundwood paper market especially, and the tariffs and resulting delays have caused havoc with the supply chain and deliveries; 3) expecting price increases in the near future due to tariffs on several commodity-based contracts; 4) expecting price increases in the near future due to tariffs on several commodity-based contracts, including waterworks items. Overall, the report adds, the past relationship between the Services PMI and the overall economy indicates that the headline corresponds to a 0.7ppt increase in real GDP on an annualized basis.

INTERNATIONAL TRADE: The US trade deficit narrowed in February to USD 122.7bln from 130.7bln in January, beneath the 123.5bln forecast via Refinitiv. The reduction in the deficit was led by a 2.9% increase in exports worth USD 278.5bln, vs no change in imports at a value of USD 401.1bln. The February decrease in the goods and services deficit reflected a decrease in the goods deficit of USD 8.8bln to USD 147.0bln and a decrease in the services surplus of USD 0.8bln to USD 24.3bln. In wake of the data, including ISM Services PMI and auto sales numbers the prior day, the Atlanta Fed GDPNow tracker was revised up to -2.8% from -3.7%, with the gold adjusted model revised up to -0.8% from -1.4%.

JOBLESS CLAIMS: Initial Jobless Claims (w/e 29th March) fell to 219k (prev. 225k) beneath the expected 225k, with the 4wk average falling to 223k from 224.25k. Note, seasonal factors had expected an increase of 5,403 (2.7% W/W), with the unadjusted data little changed at 200k. Continued claims rose more than expected, above analysts' forecast range to 1.903mln (exp. 1.870mln, prev. 1.847mln). In response, Pantheon Macroeconomics noted the 56K weekly jump in continuing claims to its highest level since November 2021, "provides further evidence that businesses are slowing hiring sharply amid heightened economic policy uncertainty". Ahead, the firm notes the risk is that the gradual upward trend in unemployment gathers momentum, "as the pace of layoffs also begins to increase, boosting the flow of initial claims".

FED

FED VICE CHAIR JEFFERSON reverberated his colleagues, noting there is no need to be in a hurry on policy rate adjustments, stating the current policy rate is well-positioned to deal with risks and uncertainties. He also repeated what Powell said, that the Fed could retain current policy restraint for longer, or ease policy, depending on inflation progress and the job market. He labelled the policy rate as "somewhat restrictive", vs Powell's "clearly restrictive" language. Jefferson said the labour market is solid and well-balanced, while the latest data shows that inflation is moving sideways. He added that longer-term inflation expectations remain consistent with the 2% goal, while the climb in goods inflation is partly due to trade policy, although the drop in housing services inflation could help counter this. He said the economy is solid, but there is heightened uncertainty among consumers and businesses tied to trade policy. The Fed Vice Chair said that if uncertainty worsens, economic activity may be constrained, although negative sentiment often does not translate to a slowdown in actual activity.

FED GOVERNOR KUGLER said the latest data indicates that progress towards the 2% inflation target may have stalled. She supports keeping the current policy rate in place as long as upside risks to inflation continue, given stable activity and employment. She noted that inflation expectations have risen and coming policy changes hold upside risk. She takes comfort that increases in long-term inflation expectations have so far been small. Given the recent high inflation, consumer expectations may be more sensitive to further price increases. Labour market indicators suggest continued moderation but not significant weakening. Kugler also noted that rolling announcements, possible retaliation and impact on expectations could also yield a more prolonged effect on inflation. The Fed Governor added that reallocation effects could produce more inflation if the US invests in areas where it does not have a comparative advantage.

FED GOVERNOR COOK echoed her colleagues, noting it is appropriate to maintain the current policy for now while watching data. She said that now is the time for the Fed to be ‘patient but attentive.’ Cook said the economy has entered a period of uncertainty, and to facilitate rate cuts, reduced uncertainty and easing inflation would need to be seen. She noted that the uncertainty related to tariffs could cause the economy to weaken. She said that encouraging inflation has moderated amid solid growth and a healthy job market. Right now, the economy is in a ‘solid position.’ Inflation data is already showing the impact of tariffs, and she is watching for evidence of tariffs driving a persistent increase in price pressures. Uncertainty is heightened by the economic outlook and government policy shifts. She is watching for evidence of trouble on longer-term inflation expectations. She said the job market appears to have stabilized but sees more evidence of slowing consumer spending and business investment. Governor Cook also sees more emphasis on upside inflation risks.

FIXED INCOME

T-NOTE FUTURES (M5) SETTLED 1 POINT 4+ TICKS HIGHER AT 112-20+

T-notes rally as Trump announces aggressive tariffs, sparking mass risk-off trade. At settlement, 2s -18.1bps at 3.723%, 3s -20.0bps at 3.687%, 5s -19.7bps at 3.756%, 7s -18.1bps at 3.886%, 10s -14.6bps at 4.049%, 20s -8.4bps at 4.499%, 30s -6.9bps at 4.483%.

INFLATION BREAKEVENS: 5yr BEI -2.4bps at 2.472%, 10yr BEI -4.9bps at 2.287%, 30yr BEI -4.3bps at 2.185%.

THE DAY: T-notes rallied across the curve on Thursday in response to the aggressive tariff announcements from US President Trump on Wednesday, sparking global risk-off trade. T-notes rallied after Trump's announcement last night, with the reopening of electronic trade seeing T-notes peak at 112-24+ before meandering overnight. However, a risk-off US session reignited the bid in T-notes, eventually rising above 113-00 to a peak of 113-02. The peaks were seen in the wake of the ISM Services PMI data, which missed on the headline, with employment falling into contractionary territory and prices paid also easing. Nonetheless, T-notes had pared back beneath 113-00 afterward and chopped a bit into settlement. Fed pricing moved dovish, with the next Fed rate cut nearly fully priced for June, with fears of an economic slowdown boosting rate cut bets. Throughout the year, 90bps of easing is now priced vs 73bps on Wednesday, which now fully prices three Fed rate cuts with a 60% probability of a fourth. This is more dovish than the March median dot plot that pencilled in two rate cuts this year, albeit those projections are already deemed stale given Trump's more aggressive approach on tariffs. However, some, like Morgan Stanley, suspect these tariffs will likely see the Fed hold for longer. The desk no longer expects the Fed to cut in June 2025, and expects the first Fed rate cut in March 2026. The Fed has made it clear that they will be watching the hard data to determine the policy path. Attention turns to NFP on Friday as well as Fed Chair Powell to see his updated views after Trump's tariff announcement.

SUPPLY:

US Treasury sold:

- USD 75bln in 8-wk bills at 4.240%, covered 2.87x.

- USD 80bln in 4-wk bills at 4.240%, covered 3.14x.

US Treasury to sell:

- USD 58bln of 3yr notes on April 8th.

- USD 39bln of 10yr notes on April 9th.

- USD 22bln of 30yr bonds on April 10th.

- USD 68bln of 26wk bills on April 7th.

- USD 76bln of 13wk bills on April 7th.

- USD 70bln of 6wk bills on April 8th.

STIRS/OPERATIONS:

- Market Implied Fed Rate Cut Pricing: May 7bps (prev. 3bps), June 25bps (prev. 18bps), July 43bps (prev. 33bps), Dec 93bps (prev. 73bps).

- NY Fed RRP Op demand at USD 196bln (prev. 233bln) across 43 counterparties (prev. 41).

- SOFR at 4.37% (prev. 4.39%), volumes at USD 2.555bln (prev. 2.589bln).

- EFFR at 4.33% (prev. 4.33%), volumes at USD 104bln (prev. 112bln).

CRUDE

WTI (K5) SETTLED USD 4.76 LOWER AT 66.95/BBL; BRENT (M5) SETTLED USD 4.81 LOWER AT USD 70.14/BBL

The crude complex was hit hard throughout the day, largely weighed on by massive risk-off sentiment after Trump tariffs coupled with a surprising OPEC+ decision. On the former, risk was hugely weighed upon after Trump tariffs hit Wall St. as they were much more aggressive than feared, and as such saw US indices crater lower, as did the Dollar, while Treasuries soared. Regarding OPEC, the eight members of OPEC+ conducting voluntary cuts are speeding up the planned return of their barrels. It will bring back the equivalent of three months' worth [under the original roadmap] in May. OPEC said the gradual increases may be paused or reversed, subject to evolving market conditions. This flexibility will allow the group to continue to support oil market stability. The eight OPEC+ countries also noted that this measure will provide an opportunity for the participating countries to accelerate their compensation. For the record, WTI and Brent saw lows of USD 65.98/bbl and 69.48/bbl, respectively, against peaks of USD 70.41 and 73.40/bbl.

EQUITIES

CLOSES: SPX -4.84% at 5,397, NDX -5.41% at 18,521, DJI -3.98% at 40,546, RUT -6.59% at 1,911

SECTORS: Energy -7.51%, Technology -6.86%, Consumer Discretionary -6.45%, Industrials -5.41%, Financials -5.01%, Communication Services -4.77%, Materials -4.19%, Real Estate -2.98%, Health -0.79%, Utilities -0.61%, Consumer Staples +0.69%.

EUROPEAN CLOSES: DAX: -3.08% at 21,700, FTSE 100: -1.55% at 8,475, CAC 40: -3.31% at 7,599, Euro Stoxx 50: -3.57% at 5,115, AEX: -2.67% at 877, IBEX 35: -1.02% at 13,215, FTSE MIB: -3.60% at 37,071, SMI: -2.34% at 12,272, PSI: +0.13% at 6,967.

STOCK SPECIFICS:

- Intel (INTC), TSMC (TSM): Tentatively agree to form chipmaking JV, according to The Information.

- Footwear/Apparel names (NKE, AEO, SKX, PVH, LULU): Face disruptions in supply chains, with Vietnam subject to 46% tariff, Cambodia 49%, China 34%, & Indonesia 32%.

- Automakers (GM, F): Trump’s 25% tariff on US auto imports, effective April 2nd, is expected to significantly raise costs & disrupt industry supply chains.

- Tech names (AAPL, NVDA): Wedbush said the Trump tariff announcement was “worse than the worst case scenario” for Wall St. & tech stocks like AAPL & NVDA will face “major pressure”.

- Pharma names outperforming (JNJ, ABBV, BMY, MRK): Received temporary reprieve, though may be short-lived as reports note WH plans additional levies on pharma imports in the future.

- eCommerce names (SHOP, CRM, ADBE): BofA noted the eCommerce software group the most directly exposed & believes that eliminating the de minimis exemption increases SHOP’s tariff exposure.

- Packaging names (BALL, CCK): 25% tariff on all imported canned beer & empty aluminium cans; Citi adds glass containers not included at the moment, implying potential upside for OI.

- Capital One (COF) deal for Discover Financial (DFS) clears DoJ hurdle, according to NYT; DoJ tells regulators doesn't see enough competition worry.

- General Motors (GM): To increase truck output at Fort Wayne assembly plant in Indiana.

- Fitch revised Southwest Airlines' (LUV) outlook to negative; ratings affirmed at 'BBB+'.

- General Motors (GM): Q1 China sales 442,000 units.

- Hershey (HSY): Reportedly near a USD 750mln deal for LesserEvil pop-corn brand, via WSJ.

- White House reportedly eyeing TikTok deal announcement for tomorrow morning, via FBN's Gasparino citing sources.

- Prada (PRDSY): Reportedly nearing deal for Versace and Jimmy Choo (CPRI), according to WWD citing sources.

- Elliott Management steps up proxy campaign against refiner Phillips 66 (PSX), FT reports.

FX

The Dollar Index slumped as US President Trump's tariff announcement was more aggressive than many had expected (at least 10% on all countries, ex Canada/Mexico), particularly on Asian countries. Namely, 34% on China, 26% on India, 32% on Taiwan, and 46% on Vietnam. The Dollar lost its appeal as a haven play in risk-off trade as growth concerns from tariffs on the US more than offset growth concerns on countries the US is to issue reciprocal tariffs on. In other words, the belief is that the US economy will get hit the hardest from said tariffs, highlighted by a couple moves: 1) US equities underperforming globally, 2) money markets now pricing ~91bps of Fed easing by year (prev. 73bps pre-Trump announcement). On trade, the baseline 10% tariff rate of 10% on all countries (ex-Canada/Mexico) is to go into effect on April 5th, while higher rates of reciprocal tariffs on "worst defenders" will go into effect on April 9th. Thus, trade will remain the key topic in the near term, and the conversation will be on whether or/if the countries targeted will make concessions to the US (via investments to the US, etc.), form cooperated countermeasures against the US, or 'simply' seek new trading partners.

US data took the back seat, given the tariff-dominated trade. ISM services PMI fell by more than expected (slump in employment weighed), initial claims fell while continued claims rose to the highest level since November 2021, and international trade narrowed. As such, Atlanta Fed GDPnow (Q1) was updated with upward revisions to the standard and "gold-adjusted" model, albeit both models still forecast a contraction in GDP growth. The Fed slate saw Jefferson and Cook hit the wires. Cook (voter) said she sees more evidence of slowing consumer spending and business investment, while Vice-Chair Jefferson sees the policy rate as somewhat restrictive. Aside from trade, Friday's main risk events include NFP and Fed Chair Powell on Friday are the main risk events.

G10 FX currencies were markedly firmer against the USD as elevated US economic woes allowed the space to surge. Havens (JPY, CHF) led the charge, while Aussie and GBP lagged with relative underperformance. The main updates involved reactions to US tariffs from Europe, Canada Australia. Regarding Europe, remarks from the Spanish PM sparked continued Dollar downside. The PM asked the European Commission for reinforcement of trade links with the rest of the world, responding to US tariffs with a EUR 14.1bln plan to protect the Spanish economy. Meanwhile, French President Macron called on big European businesses to freeze all investments in the US in relation to the US tariffs. Note, Bloomberg reported on Wednesday, that China is said to restrict companies from investing in the US, aiming for more leverage at the negotiating table. The moves to restrict US investment suggest an alternative retaliatory path countries could take vs the US. In Canada, the PM said they will impose 25% tariffs on all vehicles imported from the US that are not compliant with the USMCA trade deal; USD/CAD was muted on the response. For Australia, the PM said they are not going to impose reciprocal tariffs. Italy also expressed that they do not want to respond with more tariffs.

In Switzerland, officials said they do not currently envisage any countermeasures. Meanwhile, Swiss CPI was lower than expected in March, while SNB's Tschudin said negative rates are an option if inflation goes subzero for a sustained period.

Gold fell by ~ USD 26/oz despite risk-off trade, as perhaps profit-taking was the theme to offset equity losses. Meanwhile, some of the tariff-fear premium was likely unwound as Bullion avoided any trade tariffs. Investors had been buying spot gold ahead of the tariff announcements in case a tariff was implemented on the yellow metal.

The PBOC supported the yuan, setting its reference rate 735 pips stronger than analysts' forecasts at 7.1889, the weakest fixing since January. The wide gap vs expectations suggests the PBoC intends to curb rapid RMB depreciation.

NEVER MISS THE NEWS THAT MATTERS MOST

ZEROHEDGE DIRECTLY TO YOUR INBOX

Receive a daily recap featuring a curated list of must-read stories.

More markets stories on ZeroHedge

US Equities Explode Higher As Trump "Pauses" Reciprocal Tariffs For 90 Days (Except For China)

"Absolutely Spectacular Meltdown": The Basis Trade Is Blowing Up, Sparking Multi-Trillion Liquidation Panic