Saudi Arabia Passenger Automotive Market, Domestic Car Manufacturing, KSA Automotive Aftermarket Service Industry

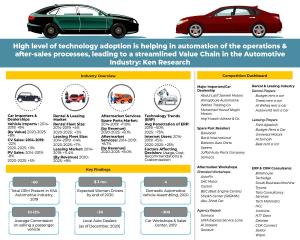

KSA Automotive Industry set to grow @ 12% amidst VISION 2030 program enabling domestic manufacturing & penetration of technology leading to automation.

SAUDI ARABIA ( KSA ), January 18, 2021 /EINPresswire.com/ -- Chinese carmaker Chery eyes Saudi Arabian market. Despite the repercussions of the pandemic for the automotive sector, Chery witnessed increased demand since the beginning of 2019, as the company launched its latest models designed with more presentable external frames and attractive interior compartments, and equipped with the latest technological features to meet the aspirations of diverse target groups in the Saudi market.The COVID-19 pandemic has accelerated the sales of cars online and convinced a growing number of customers to avoid showrooms for future purchases.

IT Spending in Automotive Market to See Huge Growth By 2025 to enable precise and authentic market estimations considering all the parameters and market dynamics.

Saudi Government’s Vision 2030: Under the Vision 2030, the KSA government aims for OEMs to produce 300,000+ vehicles in the country between 2020 & 2030. Saudi Vision 2030 aims to reduce dependence on oil exports highlight the potential for growth of logistics industry in future. Large investments in road infrastructure under Saudi Vision 2030, a 680 Km Saudi-Oman highway and the UAE-Saudi Mafraq-Ghuwaifat International Highway underway contribute to the growth of the logistics industry.

Technological Advancements and Innovations to Drive the Operational Efficiencies: Rising adoption of technologies such as RFID, Warehouse Management System, Transportation Management System and others modules enabling SAP and other ERP based integration by Car Dealerships, Car Workshops, Spare Parts Retailers & Rental Companies in Saudi Arabia is leading to improved cost efficiency within their operations. Companies have started adopting these technologies to have an edge over other players in the automotive market in the country.

Development of Domestic Automotive Industry via Skill Enhancement: Digital Skill Training & Labor Quality Enhancement program will provide more than 600,000 students & 11,000 male and female teachers with programming training to aid digitization. This will support both teachers & students in various institutes, providing highly skilled Saudi national labor to enhance quality of operations. This will further help in strengthening the car manufacturing industry across the country which aims to attract Saudi and foreign investments, increase exports, provide job opportunities, and contribute to economic diversification as part of Vision 2030 Vision.

Analysts at Ken Research in their latest publication "KSA Automotive Industry Outlook to 2025 – Focus on Technology Adoption & Trends for Dealers, Distributors, Spare Parts Suppliers, Fleet and Leasing Companies and Car service providers)" observed that there is vast opportunity to disrupt the traditional & conservatively operating automotive Industry in the Kingdom of Saudi Arabia. The report discussed the current technology adoption amongst the various segments of players such as Importers, Distributors, Spare Part Dealers, Dealerships, Workshops, car Spas, Rental & Leasing Players amongst more.

The report further analyzed each segment in detail, providing a brief overview along with market size, segmentation, competition analysis, trends, developments & future analysis of various segments, focusing keenly on entity relationships & business models.

These segments are then further analyzed to gain a better understanding of the ERP & CRM modules required to pave the way for digitization amidst the industry across KSA.

Key Segments Covered:

KSA Imports & Sales Industry (Distributors & Dealerships)

Import & Export Analysis

Competition Analysis of Major OEM Brands

Future Trends & Developments & Growth Factors

KSA Automotive Aftermarket Spare Parts & Service Industry

Spare parts Industry

Aftermarket Service Industry

Competition Analysis of Major Players via Cross Comparisons & Heat Maps

KSA Automotive Leasing & Rental Industry

KSA Rental Industry (Market Size, Competition & Segmentation)

KSA Leasing Industry (Market Size, Competition & Segmentation)

Impact of Covid-19 on KSA Automotive Industry

Impact of Covid 19 on KSA Automotive Industry

Mobility Industry looks forward to Utilize Digital Platforms

Post Covid KSA Automotive Industry Outlook

Technology Adoption & Usage Trends in KSA Automotive Industry

Overview of Industry

KSA Automotive Technology Trends, Adoption & Recommendations

Key Target Audience

KSA Car Dealerships

KSA Automotive Industry

KSA Automotive Workshops

KSA Spare Parts Retailers

KSA Automotive Logistic Service Providers

KSA Car Rental Players

KSA Car Leasing Players

KSA ERP Service Providers

KSA Technology Consultants

KSA Foreign Relation Ministry

KSA Customs Department

KSA Ports Authority

KSA Automotive Industry

KSA Imports & Export Authority

KSA Hardware Technology Manufacturers

KSA Software Technology Manufacturers

KSA Cloud Storage Providing Enterprises

KSA Public Institutions

Time Period Captured in the Report:

• Historical Period: 2014-2019

• Forecast Period: 2019-2025

Companies Mentioned:

Importers/Car Dealership

Abdul Latif Jameel Motors

Almajdouie Automotive

Wallan Trading Co.

Mohamed Yousuf Naghi Motors

Haji Husain Alireza & Co.

(Mazda, MAN, Aston Martin)

Nissan Petromin

Manahil International

Aljomaih Automotive Company

Universal Motors Agencies

Kia Al Jabr

Al Yemni Motors

Alissa Universal Motors Co.

Bakhashab Brothers Co.

Alesayi Motor Company

Al Jazirah Vehicles Agency

Juffali Automotive Company

Spare Part Retailers/Wholesalers

Balubaid

Barik International

Babatin Auto Parts

Speero

Juffali Auto Parts Company (JAPCO)

Samaco

M S Almeshri & Bros Co.

AL-OLIAH Auto Spare Parts

Delmon Group of Companies

SNAM

Ubuy

Munif Al Nahdi Group (Mize)

Odiggo

Accidom

Bawazeer Auto Parts

Bin sahib

AHQ Parts

Danya Auto Parts

Rezayat Automotive

Saudi Parts Center Company (Al Khorayef Group)

Aftermarket Service Providers

Branded Workshops

AutoFix

SAC Motor

Castrol

BEC (Best Engine Centre)

Sheikh Center (SKBMW)

Abu Jihad Car Maintenance Center

Ac Delco Service Centres

Tyre Plus

3M Authorized Centre

Mize

AdinLub

Car Spa

Car Hub

Ezhalha

Petromin Express

Auto Hub

Exxon Mobil

Autoworld

Castrol Branded Workshops

Shell Fastlube

Fuchs One

NAFT

Ziebart

Grease Monkey

Quick Car Service

Morni

Agency Repair

Samaco

United Motors Express Service Lane

Al Jazeera

Renault

Kia Motors

Fast Auto Technic

Mohammed Yousaf Naghi Motors

Porsche

Land Rover

Quick lane

Nissan Petromin

Haji Husain Alireza & Co.

Universal Motors Agencies

Aljomaih Automotive Company Ltd.

Alesayi Motors

Al Yemni Motors

Alissa Universal Motors Co.

Bakhashab Brothers Co

Al Juffali & Brothers Automotive Ltd.

Wallan Hyundai

Un-Organized/ Independent Players

Middle East Auto Services

Carzzone

German Centre

Cartech

Alod Haib

Al-Aruba Sinnaiyah

Saudi Chinese Vehicle Repair

Al Shamel Car Maintenance Center

Al Nafie Car Maintenance Workshop

Alsajow Center for Car Maintenance

Red Car

Saudi Egyptian Center for Car Maintenance

SRT 8

Al Bayan Car Maintenance

Mujahid Garage

1 Check Car Services (One Examination Workshop)

Saudi radiators

Global Auto Maintenance

Mohammed Al- Tkhais Abu Rakan

Anwar Al Mamlaka Center

Quick Cars Service

Best Corner Car Maintenance

American Diamond Specialist Center

Cars electricity and air conditioning

Badr Sentop workshop BST

Grace Monkey (International Company)

Super Service Auto Center

XEOEX

German Centre

AutoGard

Rental & Leasing Industry

Rental Players

Budget rent a car

Theeb rent a car

Al Wefaq rent a car

Autoworld rent a car

Key rent a car

Avis rent a car

Hanco rent a car

Samara rent a car

Hertz rent a car

Autorent a car

Leasing Players

Ford Aljazirah

Budget Rent a Car

Universal Motors

Al Jomaih

Best rent a car

Al Tayyar rent a car

Enterprise rent a car

Hanco rent a car

Theeb rent a car

Shary rent a car

ERP & CRM Providing Technical Consultants

Britehouse

Techedge

Saudi Business Machine

Tyconz

Accenture

Tata Consultancy Services

Tech Mahindra

HCL

Unitrans

NTT Data

Deloitte

CDK Connect

Seidor

Wipro

For more information on the research report, refer to below link:

https://www.kenresearch.com/automotive-transportation-and-warehousing/automotive-and-automotive-components/ksa-automotive-industry-outlook-to-2025/401374-100.html

Key Topics Covered in the Report:

Chevrolet Car Sales Saudi Arabia

GMC Car Sales Saudi Arabia

Saudi Arabia Auto Finance Market

Abdul Latif Jameel Car Sales

Abdul Latif Jameel Car Market Share

Aljomaih Automotive Car Sales

Aljomaih Automotive Car Market Share

Al Jazirah Car Sales Saudi Arabia

Al Jazirah Car Market Share

United Motors Car Sales Saudi Arabia

United Motors Car Market Share

Universal Motors Car Sales Saudi Arabia

Universal Motors Car Market Share

Saudi Arabia Car Competition

Online Car Sales Saudi Arabia

Online Summary Report Saudi Arabia

Online Used Car Models Saudi Arabia

Covid-19 Impact on KSA Automotive Industry

Saudi Arabia Automotive Industry Overview

Saudi Arabia Imports & Sales Industry (Distributors & Dealerships)

Automotive Imports & Sales Industry Ecosystem, KSA

Value Chain Analysis of KSA Automotive Imports & Sales

Annual Automotive Imports Traffic for Major KSA Ports

Analysis of Imported Goods & Major Countries Importing in KSA

Value & Volume of Vehicles Imported, KSA

Segmentation of Imports on the basis of Vehicle Type, KSA

Automotive Vehicle Manufacturing Clusters Analysis, KSA

New Motor Vehicle Sales, KSA

Market Segmentation of Automotive Sales on the basis of Region, KSA

Demographics of KSA Citizens Supporting Automotive Industry, (2019)

Segmentation of Vehicle Sales on the basis of Brands & Vehicle Type, KSA

Market share of International OEMs in New Vehicle Sales, KSA (2019)

Competition Analysis of Automotive Imports & Sales Industry, KSA (2019)

Profiles of Major Dealerships & Distributors

Business Model & Revenue Stream of Importers/Distributors/Dealerships

Trends & Developments in Automotive Vehicle Industry

Future of Imports & Sales

KSA Automotive Aftermarket Spare Parts & Service Industry

KSA Aftermarket Industry Ecosystem

Aftermarket Spare Parts Industry

KSA Aftermarket Service Industry

Future Trends of Aftermarket Spare Parts & Service Industry

KSA Automotive Leasing & Rental Industry

Macroeconomic Overview of the Rental & Leasing Industry

KSA Automotive Leasing (Long Term) Industry

KSA Rental Industry

Future of Leasing & Rental Industry

Impact of Covid-19 on KSA Automotive Industry

Impact of Covid 19 on KSA Automotive Industry

Mobility Industry looks forward to Utilize Digital Platforms

Post Covid KSA Automotive Industry Outlook

Technology Adoption & Usage Trends in KSA Automotive Industry

Overview of Industry

KSA Automotive Technology Trends, Adoption & Recommendations

For more information on the research report, refer to below link:

https://www.kenresearch.com/automotive-transportation-and-warehousing/automotive-and-automotive-components/ksa-automotive-industry-outlook-to-2025/401374-100.html

Related Reports

https://www.kenresearch.com/automotive-transportation-and-warehousing/automotive-and-automotive-components/saudi-arabia-used-car-market-outlook-to-2025/356552-100.html

https://www.kenresearch.com/automotive-transportation-and-warehousing/logistics-and-shipping/saudi-arabia-automotive-and-spare-parts-logistics-market-outlook-to-2025/373314-100.html

https://www.kenresearch.com/automotive-transportation-and-warehousing/automotive-and-automotive-components/saudi-arabia-car-rental-leasing-market/214914-100.html

Contact Us:

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ankur Gupta

Ken Research Private limited

+91 9015378249

ankur@kenresearch.com

Visit us on social media:

Facebook

Twitter

LinkedIn

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.