Mark Gilbert from ATN Analyzes CDK Cyber Attack for June 2024 & Forecasts July 2024 Auto Sales

Critical Insights from June 2024 Auto Sales

"The 3.0% decline in June's auto sales is notable but not entirely unexpected given the current market conditions," stated Gilbert. He added, "What stands out is the broader trend we're seeing across different segments and manufacturers."

Impact of the CDK Global Cyber Attack

"The cyber attack on CDK Global had a significant impact on sales operations," Gilbert explained. He added, "With approximately 15,000 dealerships affected, it's evident that a few deals were inevitably delayed, pushing them into July. This incident underscores the increasing importance of cybersecurity in the automotive sector."

Segment Analysis

"Passenger car sales saw a steep drop of 7.3%, while SUV and truck sales were down by 1.9%," Gilbert noted. "This indicates a shifting consumer preference, likely influenced by economic factors and fuel prices."

Company Performance Insights

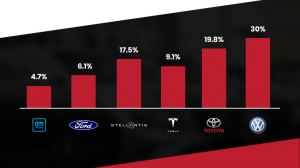

Gilbert highlighted the varied performance among major manufacturers:

General Motors, Ford, and Stellantis: "These traditional giants are facing tough times, with GM down by 4.7%, Ford down by 6.1%, and Stellantis down by a significant 17.5%. Stellantis' continuous double-digit declines are particularly concerning."

Tesla: "Tesla's 9.1% decline marks its fourth consecutive month of falling sales, raising questions about its market strategy and competitive pressures."

Japanese Automakers: "Toyota's flat performance and the moderate gains by Nissan and Honda indicate resilience among Japanese brands. Mazda's impressive 19.8% increase is a standout success!"

European Brands: "Volkswagen's nearly 30% increase is remarkable, especially when contrasted with Audi and Volvo, which saw a significant decline. This disparity highlights the varied strategies and market receptions among European manufacturers."

Best-Selling Models

"The dominance of the Ford F-Series, Chevrolet Silverado, and Toyota RAV4 is no surprise," Gilbert commented. He claimed, "These models have consistently been top performers. However, it's interesting to see the Tesla Model Y maintaining its position among the best-sellers despite the company's overall sales decline."

Market Outlook

"Looking ahead, the automotive market faces both challenges and opportunities," Gilbert said. "The 2.3% increase in year-to-date sales suggests that the underlying demand is still strong, but manufacturers will need to carefully navigate supply chain issues, cybersecurity threats, and changing consumer preferences."

July 2024 Predictions

Gilbert provided a cautious yet optimistic outlook for July 2024. He said, "Given the delayed sales from June due to the cyber attack, we expect a rebound in July's sales numbers. However, the ongoing supply chain disruptions and economic volatility will continue to pose challenges. Manufacturers that can adapt quickly to these conditions will likely see a better performance in the coming months."

"June's sales report is a mixed bag," concluded Gilbert. "While the overall decline is a concern, there are bright spots and important lessons to be learned. The automotive industry is in a state of flux, and adaptability will be key to success in the coming months."

“July will likely reward the manufacturers that embrace lower APR incentives as the fed likely takes that first leap in August or September, making lower rates more affordable in the future cost of funds trajectory.”

Carter Gilbert

Automotive Training Network

email us here

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.